A mutual fund is a type of investment vehicle that pools money from a group of investors to purchase a diversified portfolio of securities, such as stocks, bonds, or other assets. Each investor owns a share of the mutual fund, which gives them access to a professionally managed portfolio that is designed to meet the fund's investment objective.

Mutual funds are typically managed by investment professionals who use their expertise to buy and sell securities on behalf of the fund's investors. They may also adjust the fund's asset allocation over time to respond to changes in market conditions or to meet the fund's investment goals.

Investors in mutual funds benefit from diversification, as the fund's assets are spread across a range of securities and issuers, reducing the impact of any one investment on the overall performance of the fund. They also enjoy liquidity, as they can typically buy or sell their shares in the mutual fund on any business day at the current market price. Finally, mutual funds offer access to professional management and investment expertise that many individual investors may not have on their own.

There are many types of mutual funds, each with its own investment objective and strategy. Here are some of the most common

types of mutual funds:

Best Mutual Fund & SIP Investment Advisors in Ahmedabad

1. Equity Funds

These funds invest primarily in stocks or equity securities, with the goal of generating long-term capital appreciation.

4. Money Market Funds

These funds invest in short-term, low-risk debt securities, such as Treasury bills and commercial paper, with the goal of preserving capital and generating income.

2. Fixed Income Funds

These funds invest in fixed income securities, such as bonds or debt instruments, with the goal of generating income for investors.

5. Index Funds

These funds track a specific market index, such as the S&P 500, with the goal of replicating its performance.

3. Balanced Funds

These funds invest in a mix of stocks and bonds, seeking to achieve a balance of capital appreciation and income.

6. Sector Funds

These funds invest in a specific sector of the economy, such as technology or healthcare, with the goal of capitalizing on the growth potential of that sector.

7. International Funds

These funds invest in securities issued by foreign companies or in foreign markets, with the goal of generating returns from global economic growth.

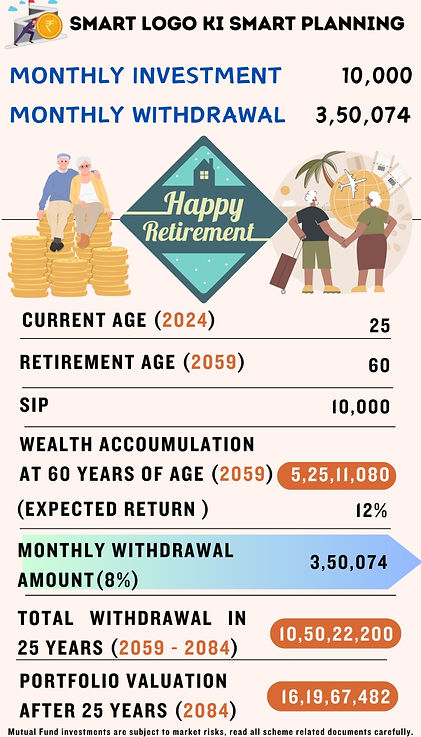

😎 Smart Logo ki Smart Planning 😎

શું તમે દર મહિને પેન્શન તરીકે Rs. 3.50 લાખ 🤩 મેળવવા માંગો છો અને તે પણ ફક્ત દર મહિને Rs. 10000 ના રોકાણ થી.

જી હા દર મહિને Rs. 3.50 લાખ અને જોડે 5.25 CR તો ખરા જ...

માસિક રોકાણ - Rs. 10000

માસિક ઉપાડ - Rs. 350074 🥳💪🏻

બજાર કિંમત - 5.25 CR😉

(in 2059)

કુલ ઉપાડ - 10.50 CR😋

(From 2059 to 2084)

(3.5L * 12 * 25)

બજાર કિંમત - 16.19 CR😁

(in 2084)

10.50 CR ઉપાડ્યા પછી પણ...

અને આ બધું જ ગણતરી માત્ર 12% વળતર મુજબ....

જે રોકાણકારો ઓછામાં ઓછું ૫ વર્ષ માટે નિવેશ કરી શકતા હોય તેમને જ આ ફંડ માં રોકાણ કરવું જોઈએ, ટૂંકા ગાળા માટે રોકાણ કરવું હિતાવહ નથી.

મ્યુચ્યુઅલ ફંડમાં રોકાણો બજારનાં જોખમોને આધીન હોય છે, સર્વ યોજના સંબંધી દસ્તાવેજો કાળજીપૂર્વક વાંચો.